What type of loan are you looking for?

Are you currently working with an apm loan advisor, who are you working with, when do you plan to buy, where is the property located.

Not available in New York. This site is not authorized by the New York State Department of Financial Services. No mortgage solicitation activity or loan applications for properties located in the State of New York can be facilitated through this site.

Are you ready to apply?

What is your current loan balance, what is the best way to reach you.

By giving us your phone number, American Pacific Mortgage has your consent to send you automated calls and texts to service your inquiry. By providing your phone number, you are giving permission to be contacted at that number and may Reply STOP to stop receiving messages or HELP for help. Your consent allows the use of text messages, artificial or prerecorded voice messages and automatic dialing technology for informational and account servicing. You don’t need to consent as a condition of buying any property, goods or services. Message/data rates may apply. By entering your information and clicking “submit," you are contacting American Pacific Mortgage and agree that we may email you about your inquiry. You also agree to our Terms of Use and Privacy Policy . You may Unsubscribe at any time by replying to any e-mail from us and change the subject line to “Unsubscribe” or e-mail us at [email protected] to Opt out.

What is the estimated purchase price?

What type of refinance interests you, someone will be in contact with you shortly., what is your estimated down payment, what is your name, how is your credit.

Estimating your score will not harm your credit and will help us provide a range of available rates.

What is the best number to contact you?

By giving us your phone number, American Pacific Mortgage has your consent to send you automated calls and texts to service your inquiry. By providing your phone number, you are giving permission to be contacted at that number and may Reply STOP to stop receiving messages or HELP for help. Your consent allows the use of text messages, artificial or prerecorded voice messages and automatic dialing technology for informational and account servicing. You don’t need to consent as a condition of buying any property, goods or services. Message/data rates may apply.

What is your email?

By entering your information and clicking “submit," you are contacting American Pacific Mortgage and agree that we may email you about your inquiry. You also agree to our Terms of Use and Privacy Policy . You may Unsubscribe at any time by replying to any e-mail from us and change the subject line to “Unsubscribe” or e-mail us at [email protected] to Opt out.

Applying with is a breeze

To begin, you will need to create a secure account. After you’ve created an account, you will enjoy:

- Secure loan application & document exchange

- Ability to pause and resume where you left off

- Updates on your application

- Capability to e-sign documents

- Easy access to resources

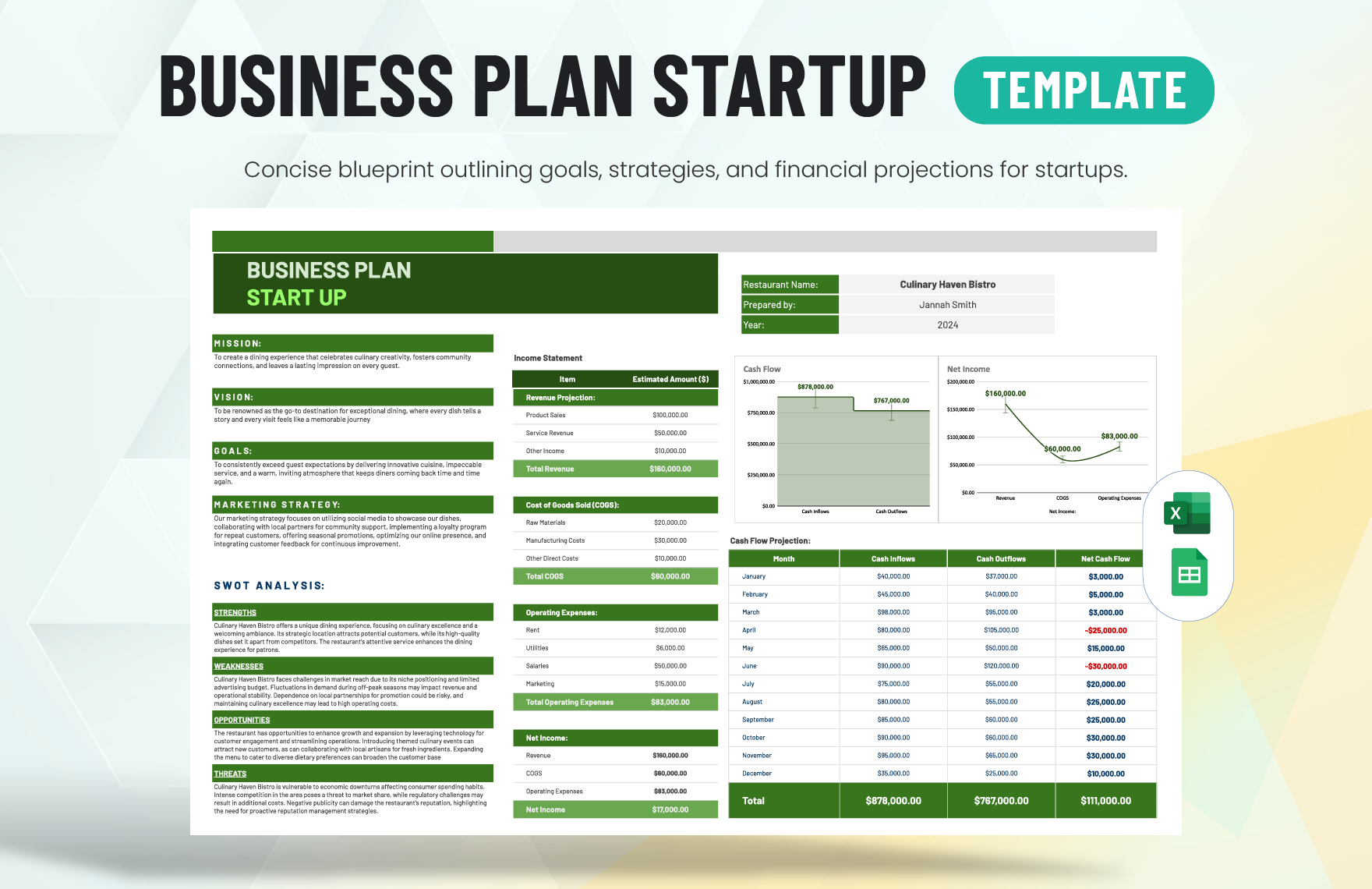

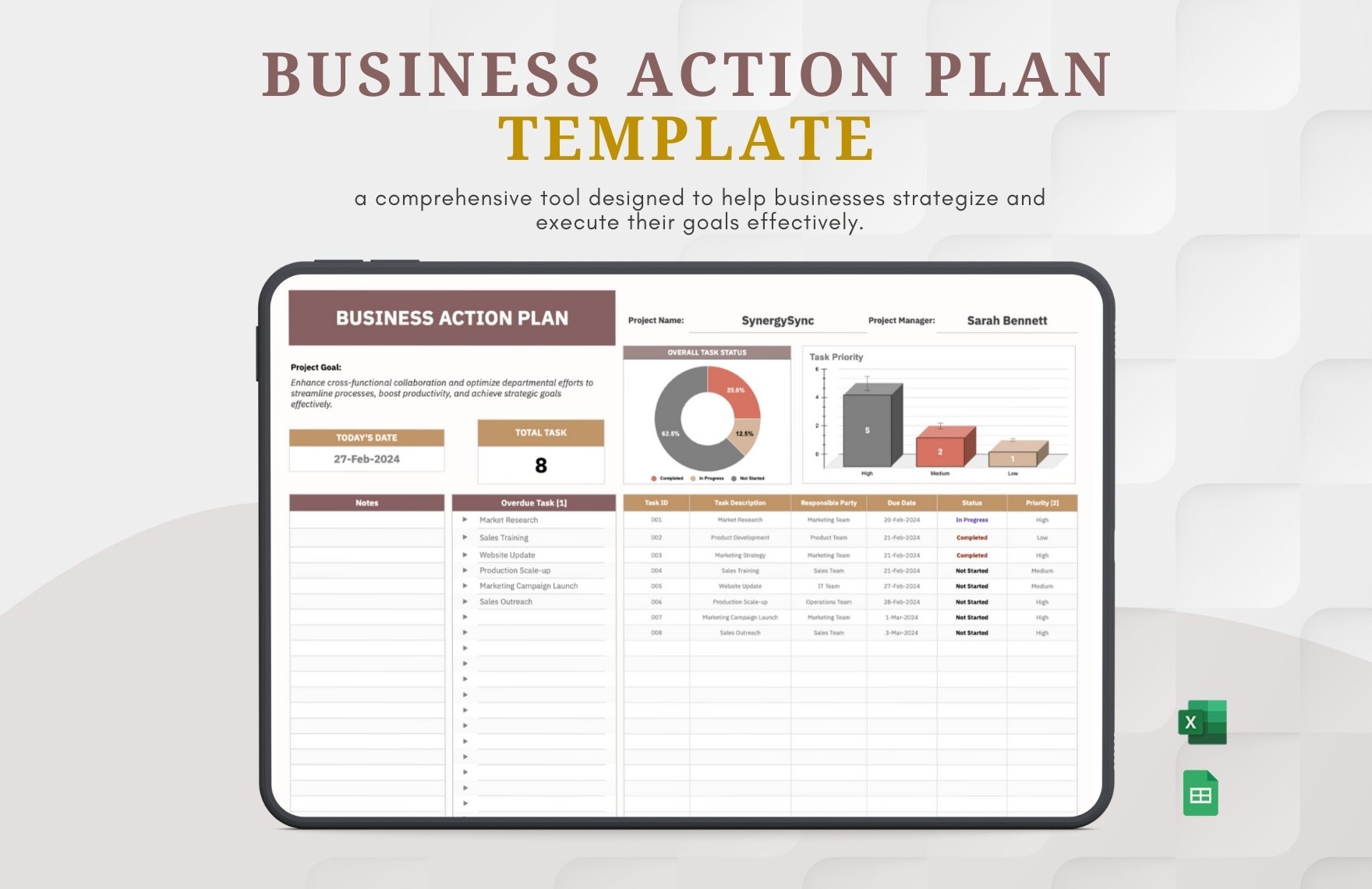

THE ART OF ORIGINATION

Complete guide to loan officer business planning.

At APM, we set aside time every year for strategic planning on how we’re going to succeed in the coming year, and we encourage all mortgage loan officers to do the same. The more intentional we are with what we want to accomplish, the more likely we are to achieve our goals.

In a rapidly changing industry, you need to outline your business objectives, set strategic goals, and review and reaffirm these plans every 90 days. That’s why we encourage our loan originators to set a 90-day plan each quarter that helps them achieve their long-term goals.

At APM, we’ve built a six-step process for mortgage loan officers to craft an effective business plan:

- Start with self-evaluation. Look back on the year and your performance both personally and professionally. We also recommend a scoring system around key areas of your business to help highlight areas of focus in the new year.

- Know your mortgage origination numbers.

- Look forward to the coming year and determine what you want to accomplish.

- Set your production goals for your business.

- Write down strategies and actions that will fuel your goals.

- Establish personal goals and strategies for balance.

Focusing on these six areas ensures that you’re covering every aspect of your work and personal life in your strategic planning, maximizing your chances for long-term success.

We’ve created a free guide that makes loan officer business planning simple and will help you evaluate your performance and set goals with action items to help achieve them.

Click here to download the APM Guide to Loan Officer Business Planning.

How to Structure Your Goals

Breaking your goal down into strategies with action items will help you achieve your overall goal. Here’s how to look at it:

- Goals: A goal is a business objective you seek to achieve by implementing the necessary strategies to get there. Goals define the destination, help you change your mindset to get to that destination, and create the need for tactics to get there.

- Strategies: Strategies are the stepping stones for achieving a goal. They’re the method or plan that will bring about the goal or the tactics that will get you from where you are to the end goal.

- Action items: These are the actions you need to take to implement your strategies. Mortgage loan officers should organize action items in the order of ideal execution.

Self-Evaluation

Before we dive into the specifics of loan officer business planning, it’s time to do an honest review of your performance over the past year. So consider what went well and what you need to tweak moving forward.

- What were your biggest business successes?

- What were some of your biggest challenges?

- What did you hope to accomplish but did not?

- Did you have a satisfying work-life balance throughout the year?

For more help, click here to download our comprehensive loan officer business planning guide .

Loan Officer Business Planning

First you’ll decide on your goals for each of the areas below for the new year. Then you’ll set one to three strategies for each of those goals every 90 days and identify the action items that will help you implement your strategies.

Strategies are simply things to keep doing, things to change, and things to start. By working your strategies with this discipline, it won’t feel so daunting to come up with something new every 90 days. Possibly it’s a small adjustment to an already-great strategy that will make all the difference.

Every 90 days, you’ll adjust as needed and plan your next 90 days. This allows you to make large goals but break down the things you need to do to achieve them without getting overwhelmed. It also builds in a specific time for you to review and reset course, which is important in the current market.

Here are the six areas to look at.

1. Strengthening referral partners (B2B)

How will you grow your relationship with strategic partners in the new year? It’s all about adding value, and here are a few of the strategies we recommend:

- Dedicate one day per week to connect with your top five real estate agents. Also reach out to two to three new real estate agents.

- Join a networking group to help build new referral partners and relationships in your community.

- Invest in lead acquisition to drive new business to yourself and your realtor referral partners.

2. Prospecting for new business (B2C)

When you’re looking for new clients, prospecting and marketing strategies are key to sourcing, transacting, and earning new business. Here are some ideas we recommend to our mortgage loan originators at APM:

- Try new marketing strategies to reach new clients. This might be adding a new social media platform, trying out geotargeted mail drops to renters, offering a free webinar on homeownership, or targeting people relocating to your area.

- Find a niche market, and create a campaign around it. This might be a specific type of home loan, a lending product with high demand and low competition, or marketing to a specific client type. Niching down can be a great strategy.

- Leverage video across all your marketing platforms.

3. Enhancing client experience

So much of what makes you successful as a loan officer isn’t the type of mortgage you offer. Instead, it’s the experience you provide the people who come to you for help with their loan options. At APM, we call this “Creating Experiences That Matter.”

That might translate into creating raving fans and referral partners for your business. Setting goals about the customer experience ensures that you never forget how important that is.

Here are some ways you could focus on your customer experience in the coming year:

- Each week, take the time to evaluate the experience you’re offering your loan applicants.

- Personalize the experience through designing memorable moments during the transaction. Determine how and where to connect, educate, and amaze.

- Use an interactive sales presentation to drive customer engagement and make the process of getting a home loan an empowering experience.

- Develop and implement a post-meeting follow-up plan for every new application. Ensure that you document the plan and that all team members adopt it.

There are a number of ways to improve your customers’ experience and make their transactions meaningful. The important thing is to make sure you’re tailoring the experience to what your specific customers want, and that won’t look the same for every loan officer.

4. Developing knowledge and skills

Loan officers can’t afford to take their eyes off professional development and mastering their craft. There are always additional things to learn, whether it’s new types of loans, mortgage officer regulatory guidelines, or a new sales technique.

In today’s high interest rate environment, your expertise is what will win you business. Here are a few action items you’ll want to have on your radar:

- Dedicate two hours per week to increase your knowledge and skill level to learn niche or new products for your business.

- Increase your knowledge of technology features and advancements for higher adoption and efficiency for yourself and your clients.

- Mentor with a top producing mortgage broker or business coach to learn the disciplines, practices, and tactics that bring success. Implement the learnings from these coaching sessions, and amend the strategies as needed.

5. Retaining clients and earning repeat business

Keeping the clients you already have is vital to loan officer business planning. Here are some action items in this area:

- How much business is sitting in your database right now waiting for you to reach out? If you don’t know, it’s time to focus some effort in this area.

- Ensure that all contacts in your database have accurate records and are signed up for automations, campaigns, and customer intelligence alerts.

- Schedule routine check-ins with past clients, something that is consistent and actionable.

- Spend time monthly reviewing contacts, content, and touchpoints and adjust as needed.

6. Personal development

It’s hard to do excellent work as a mortgage loan officer if you’re not also thriving in your personal life. That’s why one of our areas for loan officer business planning focuses on personal development. That includes setting strategic goals around several main areas of your life, including:

- Physical and mental health

- Learning and intellect

- Improving key relationships

- Financial security

- Personal aspirations

- Spirituality

There are no right or wrong answers when it comes to your personal goals. What matters is that you take the time to be intentional about what’s working and what’s not and how you can make positive changes in the coming year.

By focusing on these areas of loan officer business planning and business strategies, you’ll find that you accomplish more than you ever have before and feel better while doing it. For more help with your 2024 loan officer business plan, make sure to download our 2024 business planning book here !

Want more great content right in your inbox?

Recent posts.

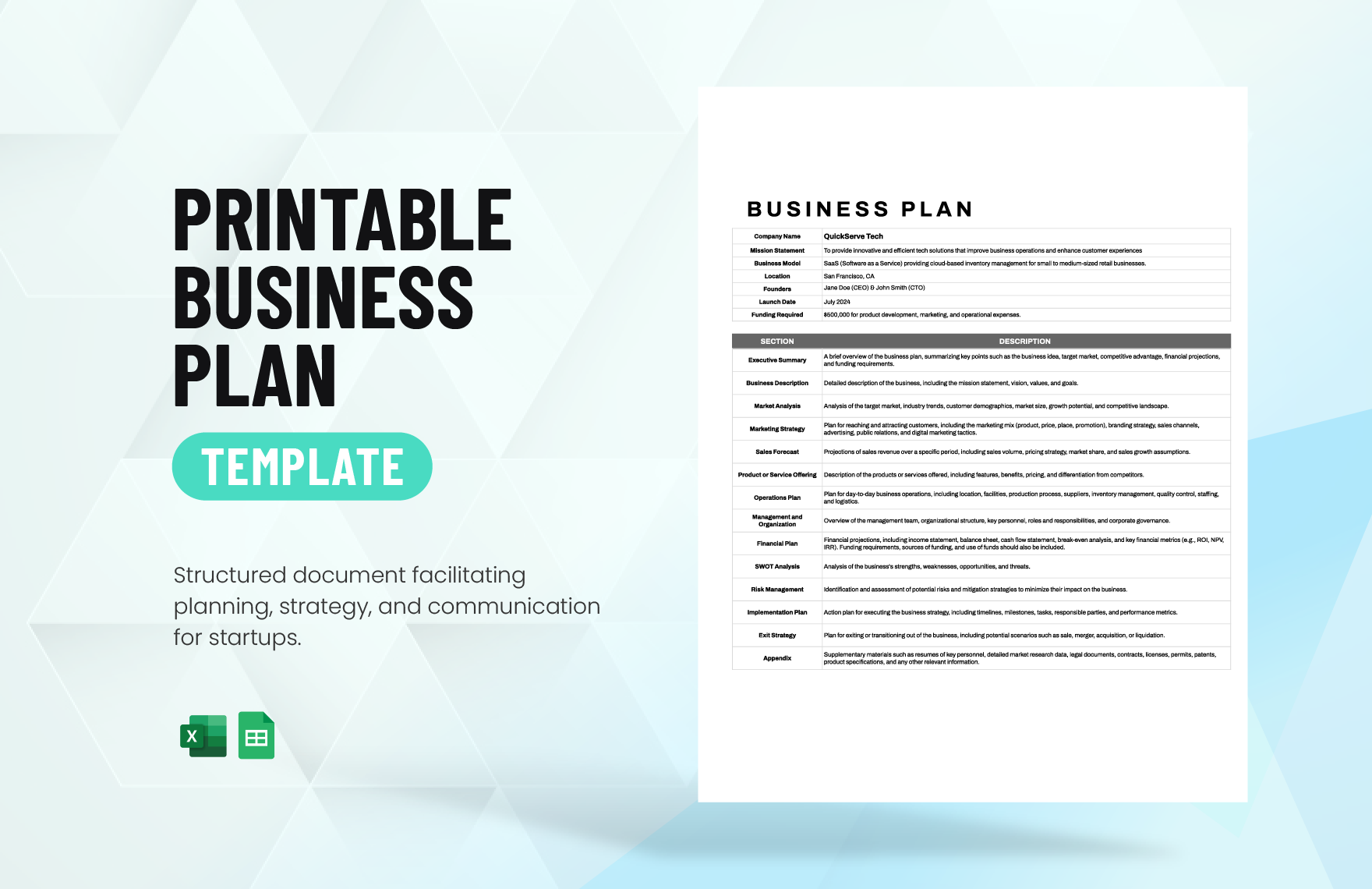

Loan Officer Business Plan Template

Written by Dave Lavinsky

Over the past 20+ years, we have helped thousands of loan officers develop business plans to grow their businesses. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through a loan officer business plan template step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is a Loan Officer Business Plan?

A business plan provides a snapshot of your loan business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for a Loan Officer

If you’re looking to grow your existing loan business, you need a business plan. A business plan will plan out the growth of your loan business in order to improve your chances of success. Your loan business plan is a living document that should be updated annually as your company grows and changes.

Finish Your Business Plan Today!

If you want to grow your loan officer business, you need a business plan. Below are links to each section of your loan officer business plan template:

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

In it you must provide an overview of each of the sections of your plan. For example, give a brief overview of the loan industry. Discuss the type of loan business you are operating. Detail your direct competitors. Give an overview of your target customers. Provide a snapshot of your marketing plan. Identify the key members of your team. And offer an overview of your financial plan.

Company Analysis

In your company analysis, you will detail the type of loan business you are operating.

For example, you might operate one of the following types of loan businesses:

- Commercial Loan Officer : this type of loan business focuses on arranging business loans.

- Consumer Loan Officer: this type of business focuses on providing loans for things such as vehicles.

- Mortgage Loan Officer: this type of loan obtains loans for consumer to purchase real estate.

In addition to explaining the type of loan business you will operate, the Company Analysis section of your business plan needs to provide background on the business.

Include answers to question such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of customers served, number of positive reviews, dollar value of loans arranged, etc.

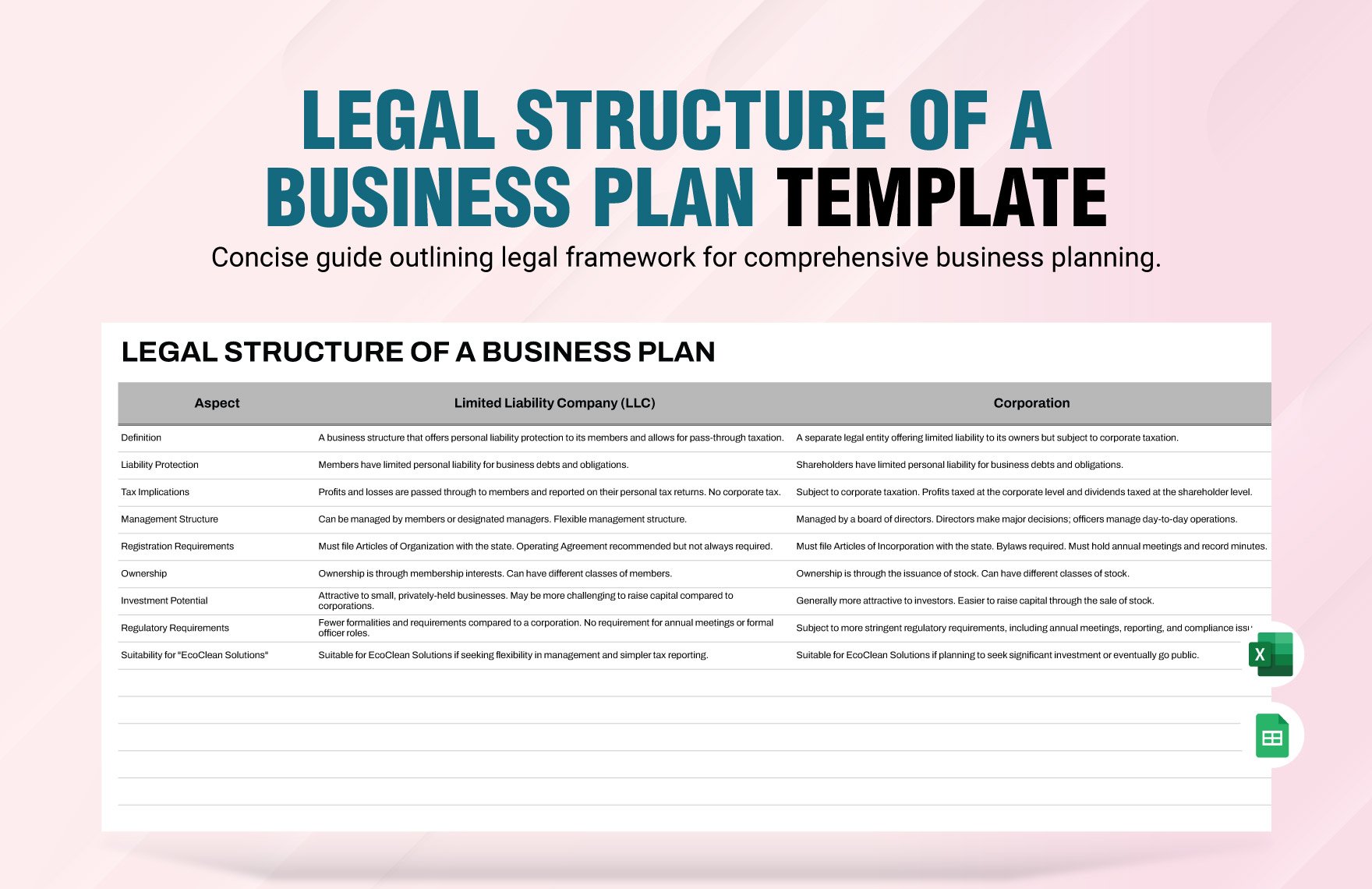

- Your legal structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry analysis, you need to provide an overview of the loan industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the loan industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your strategy, particularly if your research identifies market trends.

The third reason for market research is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your loan business plan:

- How big is the loan industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential market for your loan business? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your loan officer business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: parents, students, professionals, businesses, couples, families, prospective home buyers, prospective car buyers, contractors, etc.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of loan business you operate. Clearly, someone interested in purchasing a new car would respond to different marketing promotions than a business seeking equipment financing, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, include a discussion of the ages, genders, locations and income levels of the customers you seek to serve. Because most loan businesses primarily serve customers living in their same city or town, such demographic information is easy to find on government websites.

Psychographic profiles explain the wants and needs of your target customers. The more you can understand and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Loan Officer Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other loan businesses.

Indirect competitors are other options that customers have to purchase from that aren’t direct competitors. This includes commercial banks, online loan brokers, etc. You need to mention such competition as well.

With regards to direct competition, you want to describe the other loan businesses with which you compete. Most likely, your direct competitors will be loan officers located very close to your location.

For each such competitor, provide an overview of their businesses and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as:

- What types of customers do they serve?

- What types of loans do they specialize in?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide higher value loans?

- Will you offer lower interest rates on loans?

- Will you provide better customer service?

- Will you offer a wider variety of loan options?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a loan officer business plan, your marketing plan should include the following:

Product : In the product section, you should reiterate the type of loan company that you documented in your Company Analysis. Then, detail the specific products you will be offering. For example, in addition to loans, will you provide insurance, financial advisory, or real estate services?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your marketing plan, you are presenting the services you offer and their prices.

Place : Place refers to the location of your loan company. Document your location and mention how the location will impact your success. For example, is your loan business located near a real estate brokerage, or car dealership, etc. Discuss how your location might be the ideal location for your customers.

Promotions : The final part of your loan officer marketing plan is the promotions section. This is perhaps the most important section of your plan. Here you will document how you will drive customers to your website and/or location(s). The following are some promotional methods you might consider:

- Advertising in local papers and magazines

- Reaching out to local websites

- Social media marketing

- Local radio advertising

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your loan business, including processing loan applications, arranging signings, marketing your business, paperwork, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to arrange your 100 th loan, or when you hope to reach $X in revenue. It could also be when you expect to expand your loan business to a new city.

Management Team

To demonstrate your loan business’ ability to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally you and/or your team members have direct experience in managing loan businesses. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act like mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience as a loan officer or success being a local bank or credit union manager.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet and cash flow statements.

Income Statement : an income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenues and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you work on commission, or on a fee for services model? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets : Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your loan business, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a bank writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement : Your cash flow statement will help determine how much money you need to start or grow your business, and make sure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

In developing your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a loan business:

- Location build-out including design fees, construction, etc.

- Cost of equipment and supplies

- Payroll or salaries paid to staff

- Business insurance

- Taxes and permits

- Legal expenses

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your office location lease or outline your strategic partnerships with local realtors and lenders.

Putting together a business plan for your loan officer business is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will really understand the loan industry, your competition, and your customers. You will have developed a marketing plan and will really understand what it takes to launch and grow a successful loan business.

Don’t you wish there was a faster, easier way to finish your Loan Officer business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. See how Growthink’s professional business plan consulting services can create your business plan for you.

Other Helpful Business Plan Articles & Templates

Loan Officer Business Plan Template

Written by Dave Lavinsky

Loan Officer Business Plan

You’ve come to the right place to create your Loan Officer business plan.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Loan Officer business.

Below is a loan officer business plan template to help you create each section of your Loan Officer business plan.

Executive Summary

Business overview.

Montgomery Mortgage Loan Company is a startup mortgage loan company based in Newton, Massachusetts. The company is founded by Trent Hawthorn, a loan officer who has successfully completed over seven hundred loan packages for individuals during the past fifteen years while working for a large mortgage loan company in nearby Boston, Massachusetts.

Montgomery Mortgage Loan Company will provide loan officers experienced in the full spectrum of lending and mortgage coaching services for individuals or families. Montgomery Mortgage Loan Company will become known for their friendly and experienced loan officers, and also for the results-driven attitudes and affirming responsiveness to applicants who are served by Montgomery Mortgage Loan Company. Montgomery Mortgage Loan Company will project at least 1M in lending business within the first year.

Product Offering

The following are the services that Montgomery Mortgage Loan Company loan officers will provide:

- Conduct initial client meetings to determine lending needs, including refinancing existing loans and first-time mortgages

- Review customer applications; prepares and presents lending packages based on the client specifications

- Assist clients with completion of mortgage applications

- Review applications, research credit histories, report, assess capacities to pay and default risks

- Officers will view or visit properties for real estate purchase or refinance

- Develop and maintain contact with potential clients: realtors, developers, builders and banks or other financial institutions

Customer Focus

Montgomery Mortgage Loan Company will target individuals within the greater Boston region, including nearby townships or smaller areas near Newton.

Management Team

Montgomery Mortgage Loan Company will be owned and operated by Trent Hawthorn, a loan officer who has successfully completed over 450 loan packages for individuals during the past fifteen years while working for a large mortgage loan company in nearby Boston, Massachusetts. He has recruited two key management employees from other loan companies in the area.

Clay Singleton is a mortgage loan officer with ten years of experience in a large, nationally-recognized mortgage loan company. While with his former employer, Clay instituted a streamlined process of analyzing credit worthiness, resulting in a 28% increase in speed and, thereby, a significant reduction in package preparation time. Clay successfully completed over 300 loan packages for individuals and families during the time he was employed by the former mortgage company.

Success Factors

Montgomery Mortgage Loan Company will be able to achieve success by offering the following competitive advantages:

- Friendly, knowledgeable, and highly qualified team of Montgomery Mortgage Loan Company loan officers

- Comprehensive menu of services provided by loan officers who actively work to best represent clients in the lending process–every time on time.

- Montgomery Mortgage Loan Company offers the best pricing in town. Their pricing structure is the most cost-effective compared to the competition.

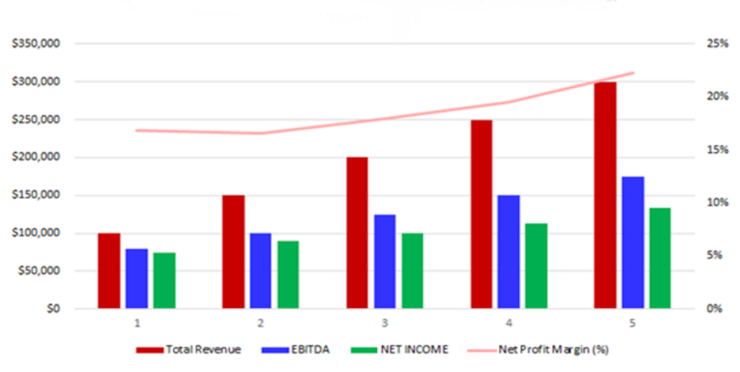

Financial Highlights

Montgomery Mortgage Loan Company is seeking $200,000 in debt financing to launch its Montgomery Mortgage Loan Company. The funding will be dedicated toward securing the office space and purchasing office equipment and supplies. Funding will also be dedicated toward three months of overhead costs to include payroll of the staff, rent, and marketing costs for the social media campaign and website development. The breakout of the funding is below:

- Office space build-out: $20,000

- Office equipment, supplies, and materials: $10,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $10,000

- Working capital: $10,000

The following graph below outlines the financial projections for Montgomery Mortgage Loan Company.

Company Overview

Who is montgomery mortgage loan company.

Montgomery Mortgage Loan Company is a newly established full-service mortgage loan company in Newton, Massachusetts. Montgomery Mortgage Loan Company will be the most reliable, cost-effective, and efficient choice for individuals in greater Boston and the surrounding communities. Montgomery Mortgage Loan Company will provide a comprehensive menu of mortgage loan officer services for any individual customer to utilize. Their full-service approach includes a comprehensive set of loan package services, application oversight and completion of mortgage loans, refinancing or first-time mortgage loan needs.

Montgomery Mortgage Loan Company loan officers will be able to manage all aspects of the mortgage application process, including refinancing and servicing of loans due to the superior customer service offered to individuals and families who seek mortgage loans in a process that can often be daunting and unfamiliar. The team of loan officer professionals are highly qualified and well-experienced in evaluating and processing loan applications and, in particular, assisting individuals through the various mortgage types and options, as well as the thorny questions found within applications and additional requirements of applicants. Montgomery Mortgage Loan Company removes all headaches and issues surrounding mortgages on behalf of their customers and ensures all issues are taken care off expeditiously, while delivering the best customer service.

Montgomery Mortgage Loan Company History

Since incorporation, Montgomery Mortgage Loan Company has achieved the following milestones:

- Registered Montgomery Mortgage Loan Company as a C-corporation to transact business in the state of Massachusetts.

- Has completed the training required for the Nationwide Mortgage Licensing System and Registry (NMLS) and is now licensed to operate in the U.S.

- Has negotiated office space in a corporate office building to set up the services of a mortgage loan company in the 10,000 square foot location.

- Reached out to numerous contacts to include Montgomery Mortgage Loan Company in the databases of available, highly-experienced loan officers.

- Began recruiting a staff of Montgomery Mortgage Loan Company and office personnel to assist and support the mortgage loan officers.

Montgomery Mortgage Loan Company Services

The following will be the services Montgomery Mortgage Loan Company will provide:

- Friendly and highly-experienced loan officers will conduct initial client meetings to determine lending needs, including refinancing existing loans or first-time mortgages

- Confidential and private review of customer applications, customer protections in place to avoid identity theft, and trust-building processes that ensure the customers are comfortable with the overall experience.

- Highly-experienced loan officer conducts application preparation and presents lending packages based on the client specifications

- Review applications, conducts research, may approve loans

- Loan officer views or visits properties for real estate purchase or refinance

- Loan officers develop and maintain contact with potential networking affiliations or collaborations: realtors, developers, builders and banks or other financial institutions

Industry Analysis

The mortgage industry is expected to grow over 7% during the next five years to over $423M. This stable growth will be driven by economic conditions that lead to increased homebuyer or homeowner trust, resulting in refinancing and first-time mortgages, in addition to traditional mortgages for homebuyers. Costs may be reduced in the future, depending on supply chain issues. It is probable that, as supply chain issues are solved and more materials become available, the costs for a loan or mortgage package will be correspondingly reduced. The cost of living expenses for the median of the population in middle-to-upper economic ranges has been steady and will likely continue to be, which stabilizes and supports the mortgage industry growth. As various materials are adapted to green or environmental standards within state laws, construction supplies and new home amenities will also change, reducing the costs of homeownership, which will invite a larger pool of mortgage applicants in the process.

Customer Analysis

Demographic profile of target market.

Montgomery Mortgage Loan Company will target those individuals and corporations in the greater region of Boston, Massachusetts in need of a mortgage or refinance package. They will also target first-time homebuyers with a strategic effort to take university graduates and other young adults into condominiums and other attached home scenarios as first-time homebuyers.

Customer Segmentation

Montgomery Mortgage Loan Company will primarily target the following customer profiles:

- Individuals and families who are refinancing or applying for a new mortgage

- First-time homebuyers who have never applied for a mortgage or large loan

- Corporations with affiliation or collaboration potential

- Community, civic or governmental agencies with specific loan funding needs

Competitive Analysis

Direct and indirect competitors.

Montgomery Mortgage Loan Company will face competition from other companies with similar business profiles. A description of each competitor company is below.

TRS Mortgage Services

TRS Mortgage Services is a mortgage loan company based in Newton, Massachusetts. It is a direct competitor to the Montgomery Mortgage Loan Company, with the primary focus on first-time homebuyers who may have little to no knowledge of the home buying process.

TRS Mortgage Services is a C-corporation and is owned by a family group with ten siblings and cousins included on the corporate register. It has 20 employees and advertises heavily to the young adult demographic, targeting under-represented nationalities within the American home buyer statistical experience. Their motto is, “Let Us Find Your First and Last Home,” and the target audience is directed toward “security” and “safety” for homeowners in the marketing strategies applied.

Silver Estates Home Loans

Silver Estates Home Loans is a direct competitor to the Montgomery Mortgage Loan Company. The company has segmented one portion of the mortgage loan industry, however, within the mobile or manufactured home mortgage loan services arena. Manufactured or mobile homes are not typically included in federal or state buying incentive programs due to the rent payments owed on a monthly basis for the land on which the manufactured homes sit. While this fact invalidates much of the mortgage loan market, Silver Estates Home Loans and others focus on meeting that niche target market and excelling within it.

Silver Estates Home Loans is an S-corporation owned by Connie Lyn and Heidi Matthews, who started the home loan company in 2015 as a result of being unable to secure a loan for their own purposes in purchasing a mobile home. Silver Estates Home Loans now services “kit” or pre-manufactured homes, as well, whether on land that is owned or leased.

Sunnyside Home Loans

Sunnyside Home Loans is a direct competitor and is owned by Hank and Mae Marsten, who formed a Limited Liability Company as the legal entity under which it operates. Sunnyside Home Loans has targeted home refinancing, first-time buyer mortgages and second mortgages for homeowners within the Boston region. A target area is that of seniors who need second mortgages for homes with no mortgages and reverse mortgage loans for seniors who need liquid assets for living expenses. Sunnyside Home Loans collaborates with federal senior agencies and the American Association of Retired Persons (AARP) to provide mortgage application education seminars and other support systems, so seniors can better understand mortgage processes. They also provide application support and expanded communication for seniors in need of comprehensive assistance.

Competitive Advantage

Montgomery Mortgage Loan Company will be able to offer the following advantages over their competition:

- Confidential and private review by loan officers of customer applications, customer protections in place to avoid identity theft, and trust-building processes that ensure the customers are comfortable with the process.

- Highly-experienced mortgage loan officers will conduct application preparation and present lending packages based on the client specification

- Loan officers will assist clients with completion of mortgage applications

- Loan officers will view or visit properties for real estate purchase or refinance

- Loan officers will develop and maintain contact with potential networking affiliations or collaborations: realtors, developers, builders and banks or other financial institutions

Loan Officer Marketing Plan

Brand & value proposition.

Montgomery Mortgage Loan Company will offer the unique value proposition to its clientele:

- Highly-qualified team of skilled loan officers who are able to provide comprehensive assistance to applicants in the home loan market sector.

- Unbeatable service in pricing for its clients. Montgomery Mortgage Loan Company loan officers will offer the lowest prices and percentage rates for the services offered and the ancillary costs attached to the loan processes.

Promotions Strategy

The promotions strategy for Montgomery Mortgage Loan Company is as follows:

Referral Marketing

Trent Hawthorn has built up an extensive list of contacts over the years by providing exceptional service and expertise to his clients. They have communicated to Trent that they kept returning for all their home mortgage needs because they were happy with the services Trent was providing as a loan officer. Once Trent advised them he was leaving to open his own mortgage loan business, they signaled their commitment to follow him to his new company and help spread the word of the Montgomery Mortgage Loan Company. This audience will be a great source of referral marketing.

Professional Associations and Networking

The pivotal area of networking will be attended to by both Trent Hawthorn and Clay Singleton, who together have over 25 years of mortgage loan officer experience. The potential for networking or joining association memberships is found in the affiliations that make sense for mortgage loan officers: real estate brokers, commercial brokers, mortgage companies, and banks or other financial institutions. These associations and networking opportunities pave the way for business, both in the immediate and long-term future.

Social Media Marketing

The oversight of social media marketing will be handled on a short-term basis by a part-time social media manager. This will include posting on social media, adding video reels, podcasts, images and other announcements that intrigue potential customers to contact the firm. The entities involved will be converted to followers on social media, who will continue to follow if material is relevant, timely and well-executed. Young adults are the largest target for this medium, and they are also first-time buyers who will be researching mortgage loans and loan officers.

Website/SEO Marketing

Montgomery Mortgage Loan Company will utilize their short-term social media marketing manager who oversees the social platforms to also design their website. The website will be well organized, informative, and list all the services that the Montgomery Mortgage Loan Company is able to provide. The website will also list their contact information and list their available interest rates and other salient information for homebuyers who are watching economic indicators.

The social media manager will also manage the website presence with SEO marketing tactics so that anytime someone types in the Google or Bing search engine, “Boston mortgage loan company” or “mortgage loan company near me”, Montgomery Mortgage Loan Company will be listed at the top of the search results.

The pricing of Montgomery Mortgage Loan Company will be moderate and on par with competitors so customers feel they receive excellent value when purchasing their services.

Operations Plan

The following will be the operations plan for Montgomery Mortgage Loan Company. Operation Functions:

- Trent Hawthorn will be the Owner and President of the company. He will oversee all staff and manage client relations. Trent has recruited the following staff:

- Clay Singleton – General Manager and Senior Loan Officer who will oversee the loan officers and handle human resources onboarding and other day-to-day operations.

- Stuart Asbury – Loan Officer, who will advise and assist corporations with mortgage loan packages.

- Elizabeth Stanton – Loan Officer, who will advise and assist homebuyers in loan packages and application processes.

Milestones:

Montgomery Mortgage Loan Company will have the following milestones complete in the next six months.

- 5/1/202X – Finalize contract to lease office space

- 5/15/202X – Finalize personnel and staff employment contracts for the Montgomery Mortgage Loan Company

- <6/1/202X - Begin networking at corporate levels

- 6/15/202X – Begin networking at mortgage industry events

- 6/22/202X – Begin moving into Montgomery Mortgage Loan Company office

- 7/1/202X – Montgomery Mortgage Loan Company opens its office for business

Montgomery Mortgage Loan Company will be owned and operated by Trent Hawthorn, a mortgage loan officer who has successfully completed over 450 loan packages for individuals during the past fifteen years while working for a large mortgage loan company in nearby Boston, Massachusetts. He has recruited two key management employees from other loan companies in the area.

Financial Plan

Key revenue & costs.

The revenue drivers for Montgomery Mortgage Loan Company are the loan origination fees and associated costs charged to the customers for their services. .

The cost drivers will be the overhead costs required in order to staff the Montgomery Mortgage Loan Company. The expenses will be the payroll cost, rent, utilities, office supplies, and marketing materials.

Funding Requirements and Use of Funds

Montgomery Mortgage Loan Company is seeking $200,000 in debt financing to launch its mortgage loan business. The funding will be dedicated toward securing the office space and purchasing office equipment and supplies. Funding will also be dedicated toward three months of overhead costs to include payroll of the staff, rent, and marketing costs for the marketing campaign and association memberships. The breakout of the funding is below:

Key Assumptions

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and in order to pay off the startup business loan.

- Number of Applications Processed and Closed Per Month: 90

- Average Costs per Month: $65,000

- Office Lease per Year: $100,000

Financial Projections

Income statement, balance sheet, cash flow statement, loan officer business plan faqs, what is a loan officer business plan.

A loan officer business plan is a plan to start and/or grow your loan officer business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Loan Officer business plan using our Loan Officer Business Plan Template here .

What are the Main Types of Loan Officer Businesses?

There are a number of different kinds of loan officer businesses , some examples include: Commercial Loan Officer, Consumer Loan Officer, and Mortgage Loan Officer.

How Do You Get Funding for Your Loan Officer Business Plan?

Loan Officer business plans are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start a Loan Officer Business?

Starting a loan officer business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Loan Officer Business Plan - The first step in starting a business is to create a detailed loan officer business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your loan officer business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks, so it’s important to do research and choose wisely so that your loan officer business is in compliance with local laws.

3. Register Your Loan Officer Business - Once you have chosen a legal structure, the next step is to register your loan officer business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your loan officer business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Loan Officer Equipment & Supplies - In order to start your loan officer business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your loan officer business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Loan Officer Business Plan [Sample Template]

Home » Business Plans » Financial Services

Are you about starting a loan officer service company? If YES, here is a complete sample loan officer business plan template & feasibility report you can use for FREE . If you live in the United States of America, you will agree that loads of entrepreneurs are making money from offering loan services. Starting a loan broker business can be demanding and risky at the same time, but if you have done your due diligence before venturing into the business, you are likely not going to run at a loss.

First and foremost, you are expected to have experience in the financial industry. It will pay you to study accountancy or banking and finance if you want to venture into this line of business. Below is a sample loan broker services firm business plan template that will help you successfully launch your own business.

A Sample Loan Officer Business Plan Template

1. industry overview.

Loan officers are part of the Loan Brokers industry and this industry is composed of establishments that arrange loans, especially mortgages, by bringing borrowers and lenders together on a commission or fee basis. The industry has loads of small business operators servicing a wide range of clients.

Suggested for You

- Mortgage Brokerage Business Plan [Sample Template]

- Micro Lending Business Plan [Sample Template]

- Merchant Cash Advance Business Plan [Sample Template]

- Payday Loan Service Business Plan [Sample Template]

- Fintech Startup Business Plan [Sample Template]

A quick of happenings in the industry revealed that the industry has fared well over the past five years as consumer confidence levels have risen. Favorable economic conditions and low interest rates have fueled consumer spending over the past five years with purchases of homes and cars increasing demand for mortgages and auto loans. As household spending on big-ticket items increases, demand for loans is also slated to increase.

As a result, industry revenue is projected to grow. The next five years are expected to be positive for the Loan Brokers industry as the general economy is expected to grow, albeit at a slower pace. However, the industry is expected to face several headwinds.

Over the next five years, interest rates are expected to increase, and, as a result, mortgages will become less attractive to consumers. The nature of the Loan Brokers industry gives room for it to perform well during recession. This is because, as consumers struggle during difficult economic times, they use industry services to access loans.

Though, as the economy continues to recover and consumers start to fatten their wallets, there is a likelihood that the demand for industry services will decline. Moreover, industry regulations have been increasing, hampering revenue growth and profit margins for firms in the Loan Brokers industry.

Statistics has it that in the united states of America alone, there are about 11,029 registered and licensed loan firms scattered all across the United States responsible for employing about 50,224 people and the industry rakes in a whooping sum of $12 billion annually.

The industry is projected to enjoy 5.8 percent annual growth within 2013 and 2018. Please note that this industry is open for fair competitions since no single establishment can boast of having a lion share of the available market.

A recent report released by IBISWORLD shows that the Loan Brokers industry operates with a low level of market share concentration; the top four companies are estimated to account for less than 6.0 percent of total industry revenue in 2018.

The industry is highly fragmented, with an estimated 11,130 enterprises in 2018. Big banks are increasingly excluding brokers from the mortgage origination process; and these trends are placing increased pressure on industry operators to consolidate. Larger brokerages can dominate local markets by attracting successful brokers who will benefit from shared marketing costs and larger client lists.

One thing is certain about starting a loan officer services business, if you are able to conduct your market research and feasibility studies, you are more likely not going to struggle to secure clients because there are always clients all across the United States who would need your services from time to time.

2. Executive Summary

Larry Pearson® Loan Broker Services, LLC is a licensed loan broker that will be based in First Avenue, Cherry Creek – Denver. The company will handle all aspects of loan services such as residential mortgages, commercial and industrial mortgages, home equity loans, vehicle loans, loans to governments, brokering and dealing products.

Larry Pearson® Loan Broker Services, LLC is a client – focused and result driven loan services firm that provides broad – based services at an affordable fee. We will offer a standard and professional services to all to our clients.

At Larry Pearson® Loan Broker Services, LLC, our client’s best interest would always come first, and everything we do is guided by our values and professional ethics. We will ensure that we hire professionals who are experienced in the loan industry.

Larry Pearson® Loan Broker Services, LLC will at all times demonstrate her commitment to sustainability, both individually and as a firm, by actively participating in our communities and integrating sustainable business practices wherever possible. We will ensure that we hold ourselves accountable to the highest standards by meeting our client’s needs precisely and completely.

Our plan is to position the business to become one of the leading brands in the loan brokers industry in the whole of Denver, and also to be amongst the top 20 loan broker firms in the United States of America within the first 10 years of operation.

This might look too tall a dream but we are optimistic that this will surely be realized because we have done our research and feasibility studies and we are that First Avenue, Cherry Creek – Denver is the right place to launch our business.

Larry Pearson® Loan Broker Services, LLC is founded by Larry Pearson. He is a graduate of Business Administration from the University of Nebraska-Lincoln; and got an MBA in Economics from Columbia Business School. Running business is a family trait Pearson inherited from his father, a stockbroker and successful businessman.

3. Our Products and Services

Larry Pearson® Loan Broker Services, LLC is going to offer varieties of services within the scope of the industry in the United States of America. Our intention of starting our loan brokers services firm is to work with clients to handle their financial needs as it relates to the services we offer.

Our business offerings are listed below;

- Brokering residential mortgages

- Brokering commercial and industrial mortgages

- Brokering home equity loans

- Brokering equipment financing arrangements

- Brokering vehicle loans

4. Our Mission and Vision Statement

- Our vision is to build a loan broke firm that will become the number one choice for both individual and corporate clients in and around Denver. Our vision reflects our values: integrity, service, excellence and teamwork.

- Our mission is to provide professional, reliable and trusted loan broker services to our clients. We will position the business to become one of the leading brands in the whole of Denver, and also to be amongst the top 20 loan broker firms in the United States of America within the first 10 years of operation.

Our Business Structure

Typically, we would have settled for two or three staff members, but as part of our plan to build a standard loan broker firm in First Avenue, Cherry Creek – Denver, we have perfected plans to get it right from the beginning which is why we are going the extra mile to ensure that we have competent, honest and hardworking employees to occupy all the available positions in our firm.

We will ensure that we only hire people that are qualified, honest, hardworking, customer centric and are ready to work to help us build a prosperous business that will benefit all the stake holders. As a matter of fact, profit-sharing arrangement will be made available to all our senior management staff and it will be based on their performance for a period of five years or more depending how fast we meet our set target.

In view of that, we have decided to hire qualified and competent hands to occupy the following positions;

- Chief Executive Officer

Loan Officers/Consultants

Admin and HR Manager

Marketing and Sales Executive

- Customer Care Executive/Front Desk Officer

5. Job Roles and Responsibilities

Chief Executive Office:

- Grows management’s effectiveness by recruiting, selecting, orienting, training, coaching, counseling, and disciplining managers; communicating values, strategies, and objectives; assigning accountabilities; planning, monitoring, and appraising job results

- In control of fixing prices and signing business deals

- Responsible for providing direction for the business

- Responsible for signing checks and documents on behalf of the company

- Assesses the success of the organization

- Accountable for brokering residential mortgages

- In charge of brokering commercial and industrial mortgages

- Responsible brokering home equity loans

- Responsible brokering equipment financing arrangements

- In authority of brokering vehicle loans

- Responsible for providing financial advice to individuals and small businesses

- Responsible for overseeing the smooth running of HR and administrative tasks for the organization

- Regularly hold meetings with key stakeholders to review the effectiveness of HR Policies, Procedures and Processes

- Maintains office supplies by checking stocks; placing and expediting orders; evaluating new products.

- Ensures operation of equipment by completing preventive maintenance requirements; calling for repairs.

- Defines job positions for recruitment and managing interviewing process

- Carries out induction of new team members

- Responsible for training, evaluation and assessment of employees

- Responsible for arranging travel, meetings and appointments

- Oversees the smooth running of the daily office activities.

- Identifies, prioritize, and reach out to new partners, and business opportunities et al

- Writing winning proposal documents, negotiate fees and rates in line with company policy

- Develops, executes and evaluates new plans for expanding increase sales

- Documents all customer contact and information

- Represents the firm in strategic meetings

- Helps to increase sales and growth for the firm

- Responsible for preparing financial reports, budgets, and financial statements for the organization

- creates reports from the information concerning the financial transactions recorded by the bookkeeper

- Prepares the income statement and balance sheet using the trial balance and ledgers prepared by the bookkeeper.

- Provides managements with financial analyses, development budgets, and accounting reports

- Responsible for financial forecasting and risks analysis.

- Performs cash management, general ledger accounting, and financial reporting for one or more properties.

- Responsible for developing and managing financial systems and policies

- Responsible for administering payrolls

- Ensuring compliance with taxation legislation

- Handles all financial transactions for the firm

- Serves as internal auditor for the firm

Client Service Executive/Front Desk Officer

- Welcomes guests and clients by greeting them in person or on the telephone; answering or directing inquiries.

- Ensures that all contacts with clients (e-mail, walk-In center, SMS or phone) provides the client with a personalized customer service experience of the highest level

- Through interaction with clients on the phone, uses every opportunity to build client’s interest in the company’s services

- Manages administrative duties assigned by the manager in an effective and timely manner

- Consistently stays abreast of any new information on the company’s products, promotional campaigns etc. to ensure accurate and helpful information is supplied to clients

- Receives parcels/documents for the company

- Distribute mails in the organization

6. SWOT Analysis

Larry Pearson® Loan Broker Services, LLC engaged the services of a core professional in the area of business consulting and structuring to assist the firm in building a well – structured loan broker services firm that can favorably compete in the highly competitive industry.

Part of what the team of business consultant did was to work with the management of our organization in conducting a SWOT analysis for Larry Pearson® Loan Broker Services, LLC. Here is a summary from the result of the SWOT analysis that was conducted on behalf of Larry Pearson® Loan Broker Services, LLC;

Our core strength lies in the power of our team; our workforce. We have a team that are trained and equipped to pay attention to details and to deliver excellent jobs. We know we will attract loads of clients from the first day we open our door for business.

As a new loan broker, it might take some time for our organization to break into the market and gain acceptance especially from corporate clients in the already saturated industry; that is perhaps our major weakness. So also, we may not have the required cash to give our business the kind of publicity we would have loved to.

- Opportunities:

The opportunities in the loan brokers industry is massive considering the number of individuals who will always need extra bucks to meet up with their monthly expenditures and even corporate organizations. As a standard and well – positioned loan broker services firm in First Avenue, Cherry Creek – Denver, we are ready to take advantage of any opportunity that comes our way.

Some of the threats that we are likely going to face as a loan brokers services firm operating in the United States are unfavorable government policies , the arrival of a competitor within our location of operation and big banks having bypassed industry operators, citing their involvement in the subprime crisis.

Despite improvements in industry performance, profit will fall short of pre – recessionary levels and that is a major threat for our business. There is hardly anything we can do as regards these threats other than to be optimistic that things will continue to work for our good.

7. MARKET ANALYSIS

- Market Trends

If you a close watcher of the trends in the industry, you will agree that the nature of the industry gives room for it to perform well during the recession. This is because, as consumers struggle during difficult economic times, they used industry services to advance their paychecks or to get quick cash back.

Though as the economy continues to recover and consumers start to fatten their wallets, there is likelihood that the demand for the industry’s services will decline. Moreover, industry regulations have been increasing, hampering revenue growth and profit margins for firms in the industry.

Although the industry is pretty much open to startups at different levels, but it is innovation, and trusted services that usually support the growths of new players in the industry. External factors such as year conventional mortgage rate and House price index impact industry performance.

8. Our Target Market

The demographic and psychographic composition of those who need the services of loan brokers cuts across both individuals and corporate organizations especially small businesses.

Larry Pearson® Loan Broker Services, LLC will initially serve small to medium sized business, from new ventures to well established businesses and individual clients, but that does not in any way stop us from growing to be able to compete with the leading loan brokers in the United States.

Our target market cuts across businesses of different sizes and of course individual clients. We are coming into the industry with a business concept that will enable us work with the small businesses and bigger corporations in and around Denver and other cities in the United States of America. Below is a list of the businesses and organizations that we have specifically designed our products and services for;

- Business men and women

- Mom and Pop Businesses

- Individuals

- Corporate executives

- Entrepreneurs and Startups

Our competitive advantage

The level of competition in the industry depends largely on the location of the business and of course the niche of your services. If you can successfully create a unique brand identity for your firm or carve out a unique market, you are likely going to experience less competition.

For instance, if you are one of the few loan brokers in your locations whose requirements for accessing loan is simple and straight forward, you are likely going to have a competitive advantage over your competitors.

Larry Pearson® Loan Broker Services, LLC might be a new entrant, but we can comfortably comply with government regulations, we have robust relationships with lenders and we have a good reputation. So also, the owner of the business is a professional and is highly qualified in the United States. These are part of what will count as a competitive advantage for us.

Lastly, our employees will be well taken care of, and their welfare package will be among the best within our category in the industry meaning that they will be more than willing to build the business with us and help deliver our set goals and achieve all our aims and objectives.

9. SALES AND MARKETING STRATEGY

- Sources of Income

Larry Pearson® Loan Broker Services, LLC is established with the aim of maximizing profits in the industry and we are going to ensure that we do all it takes to attract clients on a regular basis. Larry Pearson® Loan Broker Services, LLC will generate income by offering the following services to individuals, start – ups, NGOs and corporate organizations;

- Providing financial advice to individuals and small businesses

10. Sales Forecast

We are well positioned to take on the available market in First Avenue, Cherry Creek – Denver and other key cities in the United States of America and we are quite optimistic that we will meet our set target of generating enough income from the first six months of operation and grow the business and our clientele base beyond First Avenue, Cherry Creek – Denver.

We have been able to examine the loan brokers services market space, we have analyzed our chances in the industry and we have been able to come up with the following sales forecast. Below are the sales projections for Larry Pearson® Loan Broker Services, LLC, it is based on the location of our business and the wide range of loan brokers services that we will be offering;

- First Fiscal Year: $250,000

- Second Fiscal Year: $450,000

- Third Fiscal Year: $950,000

N.B : This projection was done based on what is obtainable in the industry and with the assumption that there won’t be any major economic meltdown within the period stated above and there won’t be any major competitor offering same commission rates as we do within same location. Please note that the above projection might be lower and at the same time it might be higher.

- Marketing Strategy and Sales Strategy

Our sales and marketing team will be recruited base on their vast experience in the industry and they will be trained on a regular basis so as to be equipped to meet their targets and the overall goal of the organization. We will also ensure that our excellent job deliveries speak for us in the market place; we want to build a standard business that will leverage on word of mouth advertisement from satisfied clients.

Our goal is to grow our loan brokers services firm to become one of the top 20 firms in the United States of America which is why we have mapped out strategies that will help us take advantage of the available market and grow to become a major force to reckon with not only in the First Avenue, Cherry Creek – Denver but also in other cities in the United States of America.

Larry Pearson® Loan Broker Services, LLC is set to make use of the following marketing and sales strategies to attract clients;

- Introduce our business by sending introductory letters alongside our brochure to corporate organizations, households, schools, Businesses, Non-Profit Organizations and key stake holders in First Avenue, Cherry Creek and other cities in Denver.

- Advertise our business in relevant financial and business related magazines, newspapers, TV stations, and radio station.

- List our business on yellow pages’ ads (local directories)

- Attend relevant international and local finance and business expos, seminars, and business fairs et al

- Leverage on the internet to promote our business

- Engage direct marketing approach

- Encourage word of mouth marketing from loyal and satisfied clients

- Join local chambers of commerce and industry with the aim of networking and marketing our services.

11. Publicity and Advertising Strategy

Below are the platforms we intend to leverage on to promote and advertise Larry Pearson® Loan Broker Services, LLC;

- Place adverts on both print (community based newspapers and magazines) and electronic media platforms

- Leverage on the internet and social media platforms like; Instagram, Facebook, Twitter, YouTube, Google + et al to promote our brand

- Distribute our fliers and handbills in target areas

- Ensure that all our workers wear our branded shirts and all our vehicles are well branded with our company’s logo.

12. Our Pricing Strategy

Fixed prices and commissions for services rendered is a long – time tradition in the industry. However, for some types of loan brokers services, flat fees make more sense because they allow clients to better predict service charge. As a result of this, Larry Pearson® Loan Broker Services, LLC will charge our clients a flat fee and interest as the case may be for many basic services.

We are aware that there are some clients that would need regular access to loan brokers services, we will offer flat rate for such services that will be tailored to take care of such clients’ needs.

- Payment Options

The payment policy adopted by Larry Pearson® Loan Broker Services, LLC is all inclusive because we are quite aware that different customers prefer different payment options as it suits them but at the same time, we will ensure that we abide by the financial rules and regulation of the United States of America.

Here are the payment options that Larry Pearson® Loan Broker Services, LLC will make available to her clients;

- Payment via bank transfer

- Payment with cash

- Payment via credit cards / Point of Sale Machines (POS Machines)

- Payment via online bank transfer

- Payment via check

- Payment via mobile money transfer

13. Startup Expenditure (Budget)

Starting a loan brokers services firm can be cost effective because on the average, you are not expected to acquire expensive machines and equipment. You should only be concerned about the amount needed to secure a standard office facility in a good business district, the amount needed to equip the office, purchase the required software applications, pay bills, promote the business and obtain the appropriate business license and certifications.

This is the financial projection and costing for starting Larry Pearson® Loan Broker Services, LLC;

- The total fee for incorporating the business in the United States of America – $750.

- The budget for basic insurance policy covers, permits and business license – $2,500

- The Amount needed to acquire a suitable Office facility in a business district 6 months (Re – Construction of the facility inclusive) – $100,000.

- The cost for equipping the office (computers, software applications, printers, fax machines, furniture, telephones, filing cabins, safety gadgets and electronics et al) – $5,000

- The cost for purchase of the required software applications (CRM software, Accounting and Bookkeeping software and Payroll software et al) – $10,500

- The cost of launching our official Website – $600

- Budget for paying at least three employees for 3 months plus utility bills – $10,000

- Additional Expenditure (Business cards, Signage, Adverts and Promotions et al) – $2,500

- Miscellaneous: $1,000

Going by the report from the market research and feasibility studies conducted, we will need over one hundred and fifty thousand ( 150,000 ) U.S. dollars to successfully set up a small scale but standard firm in the United States of America.

Generating Startup Capital for Larry Pearson® Loan Broker Services, LLC

No matter how fantastic your business idea might be, if you don’t have the required money to finance the business, the business might not become a reality.

Larry Pearson® Loan Broker Services, LLC is owned and managed by Larry Pearson. He is the sole financier of the firm, but may likely welcome partners later which is why he decided to restrict the sourcing of the startup capital for the business to just three major sources.

- Generate part of the startup capital from personal savings

- Source for soft loans from family members and friends

- Apply for loan from the bank

N.B: We have been able to generate about $50,000 ( Personal savings $40,000 and soft loan from family members $10,000 ) and we are at the final stages of obtaining a loan facility of $100,000 from our bank. All the papers and documents have been duly signed and submitted, the loan has been approved and any moment from now our account will be credited.

14. Sustainability and Expansion Strategy

One of our major goals of starting Larry Pearson® Loan Broker Services, LLC is to build a business that will survive off its own cash flow without the need for injecting finance from external sources once the business is officially running.

We know that one of the ways of gaining approval and winning customers over is to offer our loan brokering services a little bit cheaper than what is obtainable in the market and we are prepared to survive on lower profit margin for a while.

Larry Pearson® Loan Broker Services, LLC will make sure that the right foundation, structures and processes are put in place to ensure that our staff welfare are well taken of. Our company’s corporate culture is designed to drive our business to greater heights and training and retraining of our workforce is at the top burner of our business strategy.

We know that if that is put in place, we will be able to successfully hire and retain the best hands we can get in the industry; they will be more committed to help us build the business of our dreams.

Check List/Milestone

- Business Name Availability Check : Completed

- Business Incorporation: Completed

- Opening of Corporate Bank Accounts: Completed

- Opening Online Payment Platforms: Completed

- Application and Obtaining Tax Payer’s ID: In Progress

- Application for business license and permit: Completed

- Purchase of Insurance for the Business: Completed

- Conducting Feasibility Studies: Completed

- Generating part of the startup capital from the founders: Completed

- Applications for loan from our Bankers: In Progress

- Securing a standard office facility in a business district in First Avenue, Cherry Creek – Denver (Renovation inclusive): Completed

- Writing of Business Plan: Completed

- Drafting of Employee’s Handbook: Completed

- Drafting of Contract Documents: In Progress

- Design of The Company’s Logo: Completed

- Printing of Promotional Materials: Completed

- Recruitment of employees: In Progress

- Purchase of the needed software applications, furniture, office equipment, electronic appliances and facility facelift: In progress

- Creating Official Website for the Company: In Progress

- Creating Awareness for the business (Business PR): In Progress

- Health and Safety and Fire Safety Arrangement: In Progress

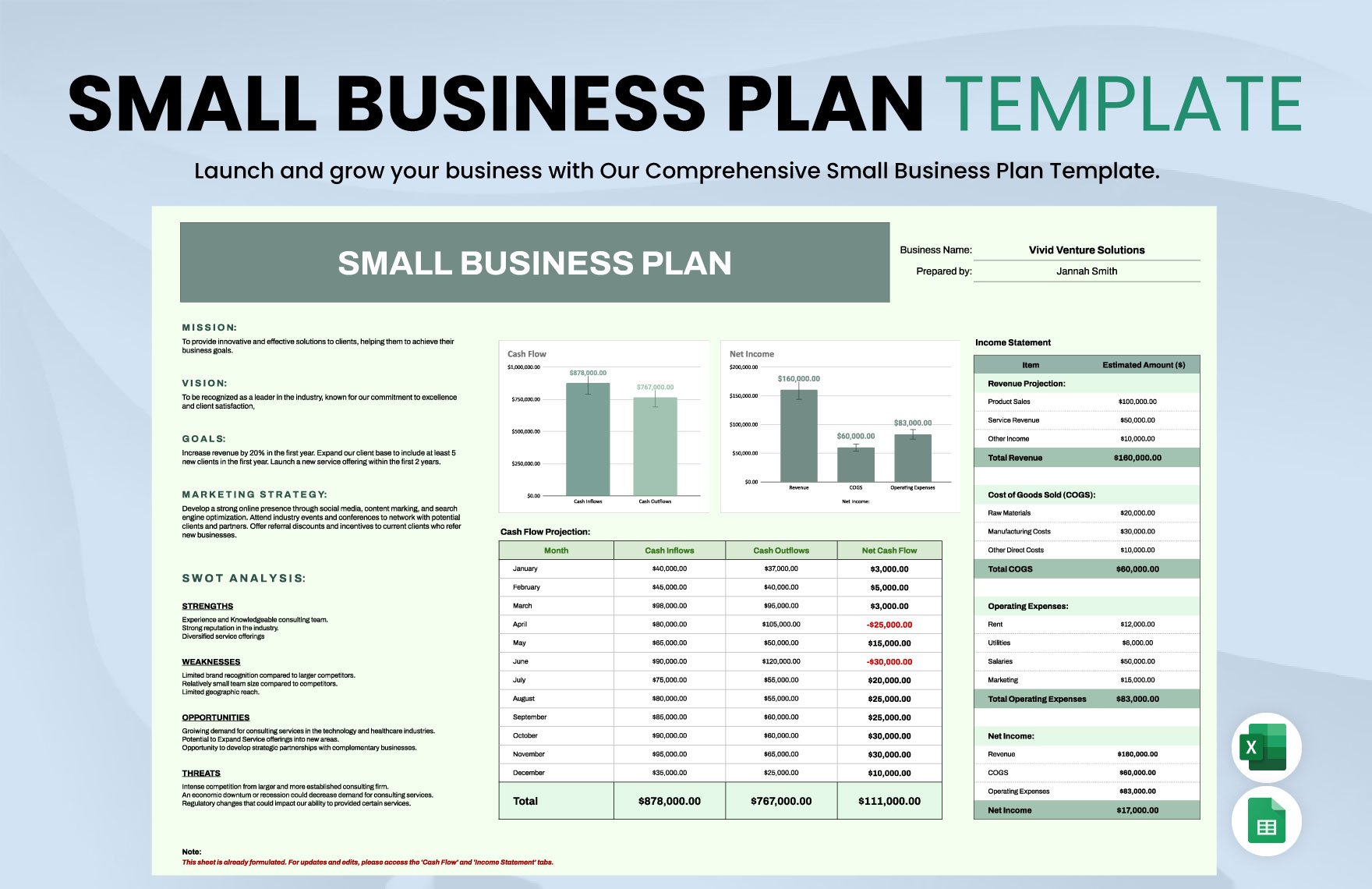

Loan Officer Business Plan Template

If you want to start a loan officer company or expand your current loan business, you need a business plan.

The following Loan Officer business plan template gives loan officer businesses the key elements to include in a winning business plan. In addition to this template, a solid plan will also include market research to help you better understand the mortgage industry, the real estate market and your specific target market. It will also help you craft a strong loan officer marketing plan and financial projections.

You can download our loan officer plan template (including a full, customizable financial model) to your computer here.

Loan Officer Business Plan Example